Limited Liability Company

Stand Alone

$1,200.00Add to Order

With Nominees *

$1,700.00Add to Order

* Nominees will be accepted only for specific cases with holding companies

With a Bank Account *

$2,400.00Add to Order

* Bank service is non refundable, and approval cannot be guaranteed

With Nominees & Bank Account **

$2,900.00Add to Order

* Nominees will be accepted only for specific cases with holding companies

** Bank service is non refundable, and approval cannot be guaranteed

Limited Liability Company in Saint Vincent and the Granadines

St. Vincent and the Grenadines is characterized by a solid offshore financial regulation and strong confidentiality laws. LLCs in St. Vincent are a separate legal person, and provide greater structure flexibility than a corporation.

Among the advantages of an LLC in St. Vincent are:

- They are tax exempt

- Both types of LLC’s, single and series, offer limited liability to its members up to their contributions to the company’s capital

- Fast incorporation, generally in two days

- Privacy, where the names of LLC’s member(s) and manager(s) are not included in public records’s certificates

- The only required documents are signed forms and the notarized copy of passport, second id and utility bill. (Is an original signed Articles of Formation which must be filed with the government Registrar).

Requirements:

- Minimum requirement of one member

- One manager; can be a natural person or a corporation

- No minimum capital amount

- A registered office address with a local registered agent

- Annual general meetings are required, but they can be held in any country

Trading Restrictions

An LLC registered with the FSA cannot have commercial activities in SVG. To conduct local business it must be registered with the Commercial Intellectual Property Office (CIPO).

Activities such as International Banks, Forex and Stock Brokers, Mutual Funds, Pension Management, Insurance Companies, and related financial activities must obtain the respective license from the relevant authorities.

St. Vincent’s FSA does not issue Forex or Stock Brokerage licenses.

LLC Agreement

A written agreement concerning the affairs of a LLC and the conduct of its business may be entered into by the members of the LLC either before, after or at the time of the signing of articles of formation and the agreement shall take effect, whenever entered into, on the formation of the LLC or upon such other date as may be provided in the agreement.

What information is publicly available?

The Registrar of Saint Vincent & the Grenadines will have the following information: articles of incorporation, certificate of formation and related company’s certificates, along with the declared information for the Manager and Members.

This information is available ONLY when requested in person at the offices of the Financial Services Authority in Kingstown, Saint Vincent and the Grenadines, and released to authorized government agencies only, or to third parties on a case by case scenario subject to the Registrar’s review and approval.

LLC Jurisdiction

This jurisdiction has two types of LLC – Single and Series. A Single LLC is the standard type, with limited liability on the entire company, (owns a single asset / business) while a Series LLC allows asset protection for numerous LLCs (called Series) under one umbrella LLC, in a similar way as the segregated cell companies (BC’s). The St. Vincent and the Grenadines Limited Liability Companies Act of 2008 allows the formation of both types.

More about Series LLC

(1) Notwithstanding anything to the contrary set forth in this Act or under other applicable law, in the event that a LLC establishes or provides for the establishment of one or more series, and if separate and distinct records are maintained for any such series and the assets associated with any such series are held in such separate and distinct records (directly or indirectly, including through a nominee or otherwise) and accounted for in such separate and distinct records separately from the other assets of the LLC, or any other series thereof, and if the LLC agreement so provides, and if notice on the limitation on liabilities of a series as referenced in this section is set forth in the articles of formation of the LLC, then the debts, liabilities, obligations and expenses incurred, contracted for or otherwise existing with respect to a particular series shall be enforceable against the assets of such series only, and not against the assets of the LLC generally or any other series thereof, and, unless otherwise provided in the LLC agreement, none of the debts, liabilities, obligations and expenses incurred, contracted for or otherwise existing with respect to the LLC generally or any other series thereof shall be enforceable against the assets of such series.

(2) Notice in the articles of formation of the limitation on liabilities of a series referenced in subsection (1) shall be sufficient for all purposes of subsection (1) whether or not the LLC has established any series when such notice is included in the articles of formation, and there shall be no requirement that any specific series of the LLC be referenced in such notice.

(3) The fact that articles of formation that contain the notice referred to in subsection (2) of the limitation on liabilities of a series, is on file with the Registrar, shall constitute notice of such limitations on liabilities of a series.

Suffixes allowed in the name of LLCs

They must contain the words “Limited Liability Company” or the abbreviation “LLC”

Bank Accounts and Brokerage Accounts Services

We have connections with banks and brokerage companies in the USA, Panama, Bahamas, St Lucia, Uruguay, Brazil, Andorra, Malta, Cyprus, Georgia, UK, South Africa, Hong Kong, Australia and Singapore, to provide secured, reliable and private Investment Trusts options, via self managed bank accounts and brokerage accounts or by managed accounts under our Trustee License.

Open your LLC today!

Contact us today to better understand your needs and we will be glad to assist you.

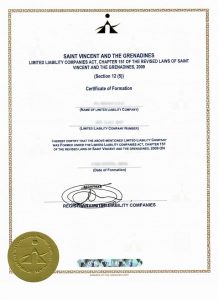

Certificate Samples